Community Property

- Holland & Knight's Community Property Team advises high-net-worth clients regarding the optimal structure for ownership of their assets for estate tax, asset protection and distribution planning.

- We assist clients in designing family governance plans to ensure that their wealth is helpful and meaningful to future generations, not harmful to them.

- Our attorneys represent high-net-worth couples in community property and common law jurisdictions, and those who change residency from one to the other.

Overview

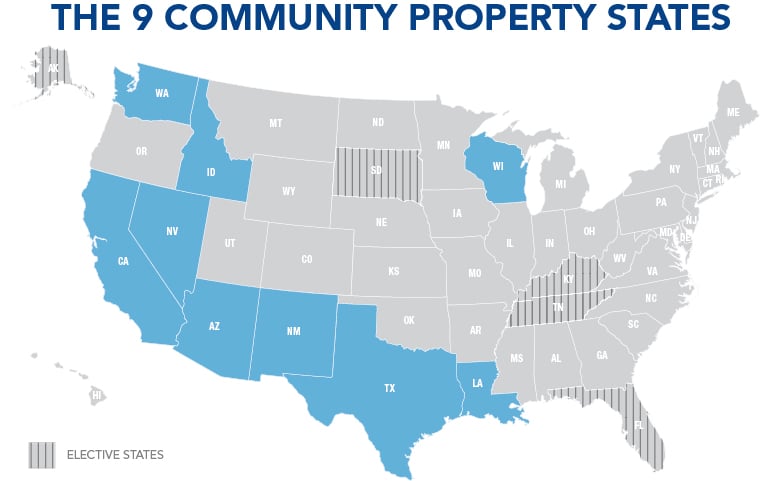

Planning for couples with assets in community property states can be considerably more complex than for couples without assets in those nine states: Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington and Wisconsin. In addition, Alaska, Florida and Tennessee are elective community property states in which spouses may create community property by entering into a community property trust or agreement.

Community property rules vary from state to state. Depending on the community property state, property owned by one spouse before marriage, as well as gifts and inheritances received during marriage, are treated as that spouse's separate property in the event of divorce. Generally, however, if a spouse uses his or her separate property to support the community, courts may decide to overlook the source of the property and focus on the uses of it, meaning the separate property of one spouse may become subject to a claim by the other spouse.

Holland & Knight's Community Property Team represents high-net-worth couples in community property and common law jurisdictions, as well as those who change residency from one to the other. Our lawyers also counsel divorcing couples considering the division of their community property, divorced clients with separate property who are thinking of remarrying, and parents who want to help their children keep their inheritances/separate property.

Here are some of the significant issues that this client set encounters:

- spousal elections and rights to inherit

- lack of planning

- migrating into and out of community property states

- quasi-community property

- differences between community property states

- opting in/opting out

- creditors' rights

- interplay with common law rules

- transmutations

- commingled funds

- disputes among family members

- premarital and postmarital agreements

- family business ownership issues

- whether their philanthropic activity is joint or separate

- spousal consents when transacting with community and/or separate property business interests

- how characterization of property as community property or separate property intersects with estate objectives of a blended family

- cross-border planning involving foreign community property jurisdictions and/or U.S. community property jurisdictions

Differentiators: Depth and Experience

Our attorneys have substantial experience in advising high-net-worth clients on all aspects of community property matters, including how to best structure ownership of their assets for estate tax, asset protection and distribution planning. Our lawyers are well versed in a host of community property state regulations and can better help transitory clients with community property and separate property issues raised by moving, including rights and obligations on divorce and death.

Holland & Knight is an international law firm, and when needed, members of our team work closely with colleagues in our Private Wealth Services Group, the largest such practice in the United States, as well as other attorneys in the firm who have extensive experience in a wide range of related areas, such as taxation, litigation and cross-border issues.